Since 2016, the trend of glass futures in China has mainly been divided into the following stages:

From 2016 to 2019, glass showed a fluctuating upward trend. On the one hand, the prosperity of the real estate market reversed upwards, stimulating developers' enthusiasm for new construction and increasing demand for glass. At the same time, environmental policies had a significant impact on the glass industry. For example, the "2+26" urban environmental policies led to glass production lines being shut down and restricted due to environmental non-compliance, resulting in a decrease in supply and a rise in glass prices, which continued to fluctuate at a high level.

From 2020 to 2021, the price of glass futures rose significantly, with violent fluctuations and increased trading volume; At the beginning of 2020, due to the impact of the epidemic, domestic real estate consumption was delayed, and the spot price of glass continued to decline until April. Later, with stimulus policies and the comprehensive resumption of construction and real estate enterprises, the demand in the terminal market increased, and glass prices began to rise, with a significant increase in trading volume and holdings compared to previous years. In 2021, from the end of the Spring Festival to early May, the overall completion cycle of real estate was affected, downstream demand gradually recovered, glass construction progress accelerated, supply and demand mismatch intensified, glass prices rose sharply, downstream real estate data was impressive, inventory was at a historical low, market bullish forces were strong, glass futures accelerated to rise, reaching a historical high point. From July to the end of 2021, real estate regulation policies became stricter, new construction and sales data weakened, and some real estate companies faced cash flow crises. Downstream demand for glass sharply declined, and prices fell sharply.

From 2022 to 2023, glass as a whole will exhibit a wide range of fluctuations; In 2022, due to weak demand and high inventory prices, the market experienced a decline. However, with supply disruptions and an increase in cold repair production lines, the market supply contracted, and prices rebounded due to the release of rush work demand at the end of the year; In the first half of 2023, as real demand fell short of expectations, some inventory was only transferred and not digested, causing a decline in the market. Traders sold goods at low prices, leading to negative feedback. After the May Day holiday, as expectations were falsified and costs were lowered, the market accelerated its downward trend; The market has re anticipated the relaxation of real estate policies, and relevant policies to boost real estate demand have been proposed one after another. At the same time, due to the deepening promotion of guaranteed delivery of buildings, the completion of real estate has ensured the base of high demand for glass. The upgrading of construction and home decoration demand, the growth of the automotive glass industry scale, and the glass market have emerged from the trough. However, the overall pattern of high-level and large-scale fluctuations was observed in the years 22 to 23.

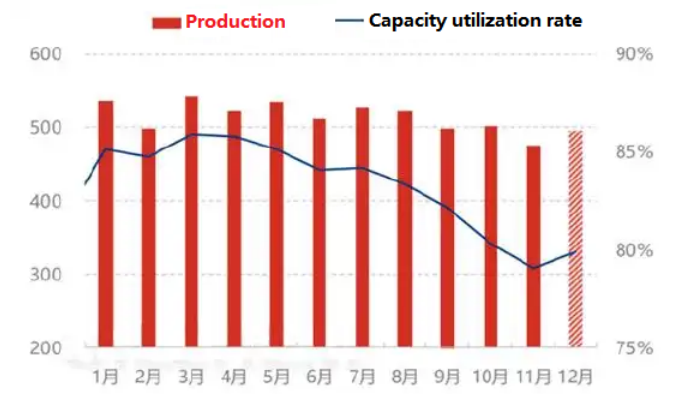

On the supply side, in early 2024, glass production was at a high level. After March, the operating rate of glass enterprises continued to decline. From August to October, the profit of float glass turned negative, and the industry's losses gradually increased. Spot prices fell sharply below costs. Under the continuous losses, the cold repair speed of glass enterprises accelerated in the third quarter, and the supply gradually contracted. By the end of November, the daily melting volume of glass had dropped from 173700 tons at the beginning of the year to 158500 tons. As of November 26th, Longzhong statistics show that the cumulative production of float glass in China is 1121.8648 million weight boxes, with a cumulative year-on-year increase of 3.42%. Due to the rigidity of glass production capacity, capacity adjustment requires price guidance. After low profits and reduced daily melting volume, it is expected that glass production will decrease year-on-year next year, and prices may continue to fall below the cost line.

Monthly production and capacity utilization rate of float glass:

Data source: Longzhong Information, compiled by Green Dahua Research Institute

Daily production of float glass:

Data source: Longzhong Information, compiled by Green Dahua Research Institute

In 2024, the production of glass enterprises shifted from profit to loss. Since the second quarter, due to the continuous decline in spot prices, the profits of production lines using natural gas as fuel have begun to decline. Compared with natural gas production lines, coal and petroleum coke production lines have stronger cost support. However, with the accelerated decline in spot prices, the entire industry has begun to suffer losses, and the magnitude has gradually increased. The profits of production lines using coal as fuel, petroleum coke production lines, and natural gas production lines all hit the bottom in September. Among them, the gross profit of production lines using natural gas as fuel reached the lowest level in recent years, reaching -400.44 yuan/ton. From September to October, the entire industry basically suffered losses. As the losses intensified, the cold repair speed of glass enterprises accelerated, daily melting decreased significantly, and supply gradually contracted. Prices... After hitting bottom at the end of September, it began to rebound and profits gradually recovered.

As the downstream of float glass, in addition to real estate accounting for the majority, automobiles rank second with a proportion of about 20%. In 2024, the domestic automobile industry benefited from the policy of exchanging old for new consumer goods and the automobile export market, and both production and sales maintained a growth trend. From January to October, automobile production and sales reached 24.466 million and 24.624 million respectively, an increase of 1.9% and 2.7% year-on-year. Benefiting from the explosion of automobiles, especially new energy vehicles, and the continuous expansion of exports, the consumption of automotive glass continues to rise and is expected to remain at a high level for 25 years. However, it is necessary to pay attention to the impact of tariff policies and trade frictions on exports after the new US president takes office.

In terms of inventory, glass companies in 2024 have rapidly accumulated inventory, with daily melting at a high level at the beginning of the year and a significant decline in real estate completion data leading to weak demand. From the beginning of the year, the inventory continued to accumulate until September 27th. At the end of September, with the support of real estate market policies, capital turnover improved, midstream speculative buying, downstream replenishment, and the driving force of the Federal Reserve's interest rate cuts, the glass industry ushered in a significant wave of destocking. The accumulation of inventory in North China and East China, as well as the speed of destocking in the fourth quarter, are much higher than in other regions. The inventory changes in Southwest and South China are relatively flat, while the inventory in factories in Northwest China remains at the level of 4 million to 6 million weight boxes throughout the year, with little fluctuation. As of 20241205, the total weekly inventory of float glass sample enterprises in China was 48.229 million heavy boxes, with a month on month decrease of -788000 heavy boxes, a month on month decrease of -1.61%, and a year-on-year increase of 46.69%. The inventory days are 22.5 days, which is 0.3 days higher than the previous period.

Glass enterprise inventory:

Looking ahead to the trend in 2025, it is expected that the glass industry will still be affected by the completion of real estate projects, with weak supply and demand. The degree of demand reduction may be greater than the decrease in supply. In the absence of a turning point in the real estate sector, as well as the possible macro impact of trade frictions, the overall glass market will remain loose and inventory will accumulate, and prices will continue to face downward pressure. Short positions will be the main focus when prices rise, and overall fluctuations may become more tortuous. We need to wait for prices to fall significantly below costs, causing passive capacity clearance, or for real estate and macro policies to bring about price rebound opportunities beyond expectations. In terms of global macroeconomics, pay attention to the pace of interest rate cuts by the Federal Reserve and the tariff policy after the new US president takes office; Domestic macro level attention is paid to the policy situation of the real estate industry.

In terms of trading strategy, attention can be paid to the supply disturbance caused by the decline in profits and losses of enterprises, as well as the demand rebound and supply-demand mismatch caused by the seasonality of real estate, which may lead to arbitrage opportunities that are strong in the near future but weak in the far future; At the same time, paying attention to the stimulus situation of real estate policies and the marginal changes on a month on month basis may provide strong support for future expectations in the far months. On the contrary, if pessimistic expectations on the real estate side intensify, the far months will be weaker; In terms of cross variety, the decline in glass production and the occurrence of destocking will affect the demand for soda ash, leading to the accumulation of soda ash and the emergence of arbitrage opportunities for the weakening of glass strength and purity.

Glass industry chain enterprises can seize the opportunity to buy and hedge during the seasonal off-season when glass enterprises suffer significant losses in profits; Seize the opportunity to sell hedging and lock in profits during seasonal peak seasons, or after loose supply and demand and stimulating policy sentiment.